Conflicting Reports Come Out on Prospect of Korean Battery Manufacturers

Foreign investment banks have recently issued negative reports on Korean battery manufacturers

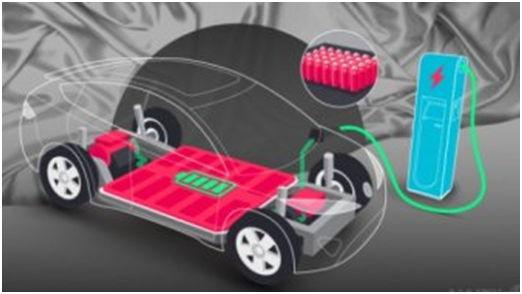

While Korea’s electric vehicle (EV) battery producers are seeking to expand their presence in the global market, conflicting reports came out about their prospects.

Korean battery companies recently saw their stock prices fluctuate following a report issued by foreign investment bank Morgan Stanley on May 30.

Morgan Stanley lowered its investment opinion about Samsung SDI from neutral to underweight and its target stock price from 570,000 won to 550,000 won, saying that pressure on battery manufacturers is growing due to the emergence of new companies in the battery industry.

While the EV market will grow 20 percent annually over the past 10 years, battery manufacturers’ profitability will fall short of this growth pace due to excessive competition, the report forecast.

The report, coupled with the entry of a growing number of startups into the battery industry and a spate of battery internalization announcements by carmakers, fueled concerns about traditional battery companies.

Prior to this, on May 26, Credit Suisse (CS) released a report to slash its target stock price of LG Chem from 1.3 million won to 680,000 won, saying that a holding company discount should be applied to LG Chem following the spin-off of LG Energy Solution.

In response to such negative reports by foreign securities firms, some analysts said that these reports reflect realities of the battery industry.

Tesla, the No. 1 electric vehicle maker, as well as GM, Ford, Hyundai Motor, and Toyota laid out plans to internalize batteries in the mid- to long-term, making the battery industry nervous.

On the other hand, B3, a global battery market research company, recently drew attention by pointing out in a report the loopholes in automakers’ battery internalization plans.

B3 expressed skepticism about Volkswagen’s plan to put new square batteries into electric cars from 2023, raise the ratio to 80 percent by 2030, and eventually internalize batteries. The plan was disclosed at the company’s first battery day dubbed “Power Day” on March 15. At the time, many industry insiders were concerned that LG Energy Solution and SK Innovation would lose one of their their important customers because they produce pouch-type batteries rather than square ones.

B3 said in the report that while Volkswagen’s intention is understandable, it will be very difficult for Volkswagen to produce batteries on its own. It also said it was premature for the company to declare the adoption of square batteries. Due to the nature of the battery industry, which requires technical skills and production know-how, it takes a long time for startups to have stable mass-production systems.

It remains to be seen whether carmakers will produce all batteries they need on their own, even if they acquire battery companies and expand their battery production. Analysts says that although they may produce some batteries to lower the procurement costs of batteries, which account for 30-40 percent of the EV production costs, it is unlikely for them to internalize 100 percent of batteries, in light of the risks involved, such as fire, recalls and high technology development cost.

Industry insiders believe that establishing joint ventures with battery companies will be a realistic alternative for carmakers. Ford recently held its first battery day and announced that batteries of 240 GWh will be needed annually by 2030. The U.S. carmaker added that it will internalize batteries in the future but will employ a “multi-battery, multi-vendor” strategy.

Those in the battery industry are predicting that battery makers’ establishment of joint ventures with finished car manufacturers will further accelerate in the future. LG Energy Solution and SK Innovation recently announced plans to establish joint-venture plants in the United States with GM and Ford, respectively. LG Energy Solution will also sign a memorandum of understanding (MOU) with Hyundai Motor as early as this week to set up a battery joint venture in western Indonesia. SK Innovation and Samsung SDI are also preparing to establish joint ventures with global automakers including Hyundai Motor.