[Contribution] What ails Korea’s housing market?

|

| Chunyu Yang, researcher at ASEAN+3 Macroeconomic Research Office (AMRO). Courtesy of AMRO |

By Chunyu Yang

Since 2018, Korea has witnessed rapidly rising housing prices, particularly in the Seoul metropolitan area, resulting in growing concerns among policymakers and homeowners alike. Housing prices in Korea have increased by nearly 20 percent since January 2020, and a house can now cost more than 10 times the average annual household income. The problem is even more acute in the Seoul metropolitan area with housing prices rising by almost 25 percent in the same period, far outpacing many Asian metropolises such as Beijing, Hong Kong, and Singapore.

The accompanying rise in household debt and potential risks of a housing price correction may pose serious challenges for the government, if not checked. At the same time, dreams of home ownership seem increasingly distant for people, particularly the younger generation.

|

Reasons for the surge

One key problem is the supply-demand gap. The number of households has grown faster than the population over the past 20 years, implying the average size of households has become smaller. Remarkably, more than half the households only comprises one or two persons. This is likely one of the factors that has boosted the demand for housing, especially small ones.

Besides, the Seoul metropolitan area, which comprises less than 12 percent of Korea’s land area, and already home to half its population, continues to see an inflow of people from other parts of the country. Thus, this area ― particularly Gyeonggi Province and Incheon ― has seen even higher growth in the number of households since 2016.

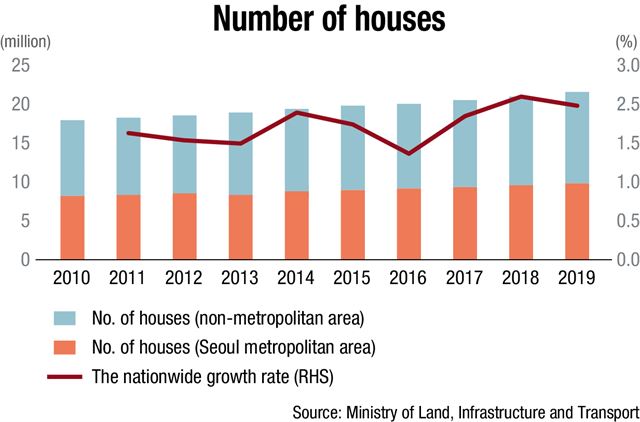

On the other hand, housing supply is generally inelastic in the short-term, given that time is needed to plan, develop and implement projects and to complete construction. In Korea, housing supply has increased steadily by more than 2 percent per year in the three years leading to 2019 to reach 21 million, but there is still a shortage in the Seoul metropolitan area. According to our study in the 2021 Annual Consultation Report on Korea, an additional 158,000 houses are needed to provide one house for each household in Seoul.

With the demand-supply imbalance, housing transactions and prices can easily rise if there is excessive liquidity in the market. In 2020, in response to the COVID-19 pandemic, various economic stimulus policies were implemented, injecting massive liquidity into the economy and reducing the cost of credit. As a result, housing loans increased by 17.5 percent in 2020, the highest growth rate ever. Meanwhile, housing transaction volume reached its highest level in over a decade, and the number of unsold housing units fell to its lowest.

Warning signs and policy measures

Rapid increases in housing prices and excessive lending are seen as indications of accumulating financial imbalance. Although Korean experts do not see a bubble in the housing market yet, some indicators, such as the surging household debt-to-GDP ratio, should be monitored closely. According to the Korea Economic Research Institute, the household debt-to-GDP ratio stood at 103.8 percent as of the end of 2020, having increased by 16.5 percentage points since 2016, compared to global private debt growth of 11.2 percentage points.

|

This also makes it challenging for the government to exit from the accommodative monetary policies implemented during the pandemic. Since the beginning of 2021, the economy has recovered quickly in terms of GDP growth rate and employment. While this can provide a window for normalizing monetary policy, a rate hike could increase the debt-servicing burden for households and trigger a correction in home prices.

Over the past few years, the Korean government has introduced several measures to cool down the housing market. Since 2017, the government has announced several actions to curb rising housing prices, including tightening mortgage loan regulations, increasing taxes for those who own multiple homes, taxing proceeds from the rapid resale of properties, and improving protection for tenants. In 2020, the loan-to-value ratio and debt-to-income ratio were further tightened, and more tax measures were announced, including raising the comprehensive real estate tax, acquisition tax and capital gains tax. This may reduce investment demand in the housing market.

To narrow the demand and supply gap in the metropolitan housing market, the government has made many efforts to increase housing supply in the Seoul metropolitan area. In 2018 and 2019, the government announced three housing supply plans for the Seoul metropolitan area, along with transportation network plans and new town construction plans. At the beginning of 2021, another massive home supply plan was announced. If these plans are implemented successfully, 1.18 million new houses will be supplied in the metropolitan area, equivalent to roughly 5.8 percent of the current number of households there.

In the long run, housing supply will increase to meet the demand, given various housing supply plans and demographic changes. However, in the short-term, the trend of surging home prices and the associated risk of financial instability are worrying. Stringent macroprudential measures and property-related tax measures remain necessary to contain the financial risk. Meanwhile, the government should continue to increase the supply of public housing, and encourage more private developers to participate in the housing-supply program.

The writer is researcher at ASEAN+3 Macroeconomic Research Office (AMRO)